- Home

- /

- Programming

- /

- SAS Studio

- /

- calculate rolling window beta

- RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

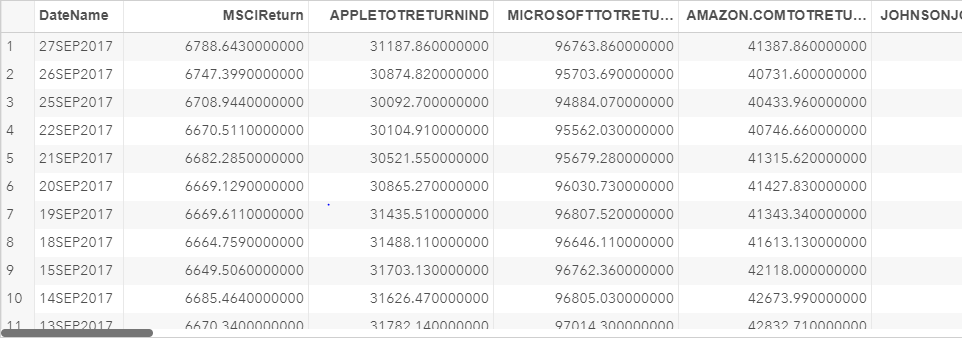

I am doing a research where I have to find the monthly beta of around 1000 stocks for 15 years. I have created a SAS table which contain daily historic data of all the stocks and also the market from 2002 to 2017. I would like to find the monthly beta with 30 data points without overlapping values. I would highly appreciate if somebody could help with the coding.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

What is Beta? Please post some sample data that reflects your actual data and anything you've attempted as well.

@renjithradhakri wrote:

Hi,

I am doing a research where I have to find the monthly beta of around 1000 stocks for 15 years. I have created a SAS table which contain daily historic data of all the stocks and also the market from 2002 to 2017. I would like to find the monthly beta with 30 data points without overlapping values. I would highly appreciate if somebody could help with the coding.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Thank you for your reply!

In excel beta is often calculated by either calculating the slope or by covariance.

Beta =covariance.p(B2:B32,A2:A32)/var.p(A2:A32) or

Beta = SLOPE (A2: A32; B2:B32)

In this formula column A is the market and B is the stock to be calculated. In the screen shot MSCI_Return is the market.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Do you have SAS/ETS? If so, look into PROC EXPAND. If you don’t, there are also some links here on how to do that with a data step.

If you search on here, this has been asked at least twice this year so far and there are answers on here as well.

https://blogs.sas.com/content/iml/2016/01/27/moving-average-in-sas.html

Get started using SAS Studio to write, run and debug your SAS programs.

Find more tutorials on the SAS Users YouTube channel.

SAS Training: Just a Click Away

Ready to level-up your skills? Choose your own adventure.