- Home

- /

- Programming

- /

- SAS Studio

- /

- Re: Need new variable for annualized returns

- RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Good afternoon,

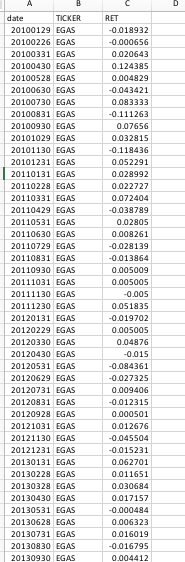

In my firm performance dataset I have monthly return figures for firms from 2010-2017. I would like to have a new variable that is annual return. Could you help me create a datastep which I can use for the whole dataset to show annualized returns for each firm? That way I could match it to CEO salaries in my other dataset. I will attach a screenshot of what the data look like. Any help is super appreciated!

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Part of the answer depends on the data.

Do you always begin with January and end with December?

Is DATE a SAS date, or merely a numeric value with YMD?

Is your data in sorted order by TICKER DATE?

Assuming "yes", "just a number", and "yes", you could program it in this way:

data temp;

set have;

by ticker date;

retain annual_return 1;

annual_return = annual_return * (1 + RET);

month = int( mod(date,10000) / 100);

if month = 12;

annual_return = (annual_return - 1) * 100;

output;

annual_return = 1;

run;

If DATE is actually a SAS date, the calculation of MONTH is easier:

month = month(date);

Note that the annualized return is calculated separately for each year. If you get 10% for one year, and 20% for the next year, the total value after two years would be 1.1 * 1.2 * original value ... all assuming that I got the formulas correct. So check that the results look reasonable (I can't test this right now.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Can you please post your sample data and expected output in the form of a datastep or at least plain text. I don;t think many would be interested in converting a screen shot to a real dataset.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

what is the best way to post my sample data? Also what do you mean by expected output in the form of a data step?

thanks for the help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

I need to substitute the decimal form of the firm's return for the one-month periods into the following formula: [((1 + R)^12) - 1] x 100 , using a negative number for a negative monthly return.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Instructions on how to provide sample data are here:

By expected output, what would you expect as results from the sample data you've posted. Ideally, they align, so the answers in the output match up with the sample data you provided so someone can test their code.

@sastuck wrote:

I need to substitute the decimal form of the firm's return for the one-month periods into the following formula: [((1 + R)^12) - 1] x 100 , using a negative number for a negative monthly return.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

@sastuck At the very least,you could copy paste the sample from excel as text and not as images. The expected output the same thing, meaning the results that you expect to be populated in the output dataset derived using your sample.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

|

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

I apologize if this is hard to work with--I am in my first year of using SAS. You'll see in the data I copy and pasted that I have monthly return data. I would like to create a new variable which is one figure for each month. So annualized return per firm. This dataset shows 2010-2017, so there should be 7 rows per firm ideally

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Ok...instead of that please right click the data set and view in Excel. Select just the records you want to share with us and then save as a csv file and upload that.

The data you pasted above has a lot of line feeds and extra information.

You can either attache the CSV data or insert it directly using the notepad icon, 6/7th icon on the Rich Text editor here.

{ i } icon.

That will insert it as text, not html.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Part of the answer depends on the data.

Do you always begin with January and end with December?

Is DATE a SAS date, or merely a numeric value with YMD?

Is your data in sorted order by TICKER DATE?

Assuming "yes", "just a number", and "yes", you could program it in this way:

data temp;

set have;

by ticker date;

retain annual_return 1;

annual_return = annual_return * (1 + RET);

month = int( mod(date,10000) / 100);

if month = 12;

annual_return = (annual_return - 1) * 100;

output;

annual_return = 1;

run;

If DATE is actually a SAS date, the calculation of MONTH is easier:

month = month(date);

Note that the annualized return is calculated separately for each year. If you get 10% for one year, and 20% for the next year, the total value after two years would be 1.1 * 1.2 * original value ... all assuming that I got the formulas correct. So check that the results look reasonable (I can't test this right now.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

the date does not always begin with january/end with december. Also, what exactly is a SAS date?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

SAS expects to store dates as integers. Arbitrarily, 0 is equivalent to January 1, 1960. You can see this for yourself:

data test;

do x=0 to 10;

output;

end;

run;

proc print data=test;

format x date9.;

run;

proc print data=test;

format x yymmdd10.;

run;

One question about what you want before I go changing the program ...

If the first observation for a ticker is in April, do you want the first observation in the output to run April through December, or do you want it to run April through the following March?

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

With your suggestion, this is what I ended up with.

There are many missing observations, but it appears to have worked?

| row | date | ticker | cusip | monthly return annual return |

| 190 | 20121231 | AAN | 253530 | -0.014634 | 6.2307808656 |

| 191 | 20131231 | AAN | 253530 | 0.026536 | 4.226821326 |

| 192 | 20141231 | AAN | 253530 | 0.077167 | 4.2817206905 |

| 193 | 20151231 | AAN | 253530 | -0.077462 | -26.52987081 |

| 194 | 20161230 | AAN | 253530 | 0.099502 | 43.452160793 |

| 195 | 20171229 | AAN | 253530 | 0.057264 | 24.946061871 |

| 196 | 20101231 | AAON | 36020 | 0.099805 | 46.882111929 |

| 197 | 20111230 | AAON | 36020 | -0.064811 | 7.6652957857 |

| 198 | 20121231 | AAON | 36020 | -0.008551 | 3.6715155717 |

| 199 | 20131231 | AAON | 36020 | 0.038349 | 131.07860291 |

| 200 | 20141231 | AAON | 36020 | 0.080598 | 5.9833021736 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Does "missing observations" coincide with data that ends before December?

If you were to look at the monthly numbers for AAON, do the annual numbers look right?

Get started using SAS Studio to write, run and debug your SAS programs.

Find more tutorials on the SAS Users YouTube channel.

SAS Training: Just a Click Away

Ready to level-up your skills? Choose your own adventure.