- Home

- /

- Programming

- /

- Programming

- /

- macro if then else

- RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

I am trying to make a program that will calculate taxes based on brackets. Here are my brackets:

data tax;

input from1 1-6 to1 7-20 rate 21-24;

datalines;

0 18567 0.1

18568 34821 0.15

34822 65733 0.2

65734 9999999 0.25

;

run; I treid to do the following macro to calculate the taxes for each bracket:

%macro taxes (salary);

data tax_brackets;

set tax;

%if (&salary > to1) %then %do;

tax_bracket = (to1 - from1)*rate;

%end;

%else %if (from1 <= &salary <= to1) %then %do ;

tax_bracket = (&salary-from1)*rate;

%end;

%mend;

%taxes (45000);But only for the 3rd observation I get the intended result (which corresponds to the %else %if in the macro), while in all of the other observations I get a bad result.

Thanks!

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

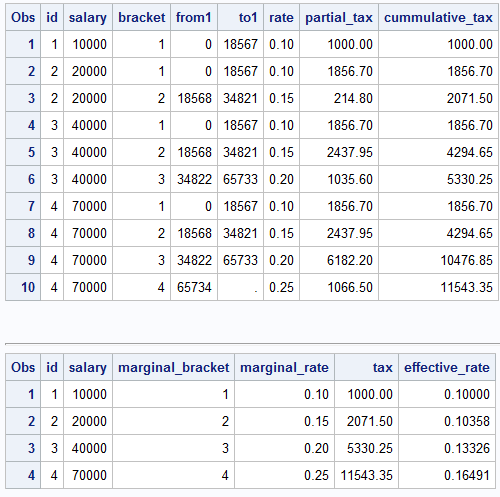

I don't think that is how taxes work. You only pay the higher rate on the part of the salaray that falls in the higher bracket.

You probably want something more like this. First let's create a tax table and some example employee data.

data tax_brackets;

bracket+1;

input from1 to1 rate ;

cards;

0 18567 0.10

18568 34821 0.15

34822 65733 0.20o

65734 . 0.25

;

data have;

input id salary ;

cards;

1 10000

2 20000

3 40000

4 70000

;

Now let's combine the two tables. I will output both the detailed by bracket taxes and the overall per employee taxes.

data detail(drop=effective_rate rename=(tax=cummulative_tax))

final(drop=partial_tax from1 to1

rename=(rate=marginal_rate bracket=marginal_bracket)

)

;

set have ;

if 0 then set tax_brackets ;

do p=1 to nobs until (salary < to1);

set tax_brackets point=p nobs=nobs;

partial_tax=rate*(min(salary,to1) - from1);

tax = sum(0,tax,partial_tax);

output detail;

end;

effective_rate = divide(tax,salary);

output final;

run;- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

I dont see the need for a macro here. This seems simpler to me

data tax;

input from1 1-6 to1 7-20 rate 21-24;

datalines;

0 18567 0.1

18568 34821 0.15

34822 65733 0.2

65734 9999999 0.25

;

%let salary = 45000;

data tax_brackets;

set tax;

if &salary > to1 then tax_bracket = (to1 - from1)*rate;

else if (from1 <= &salary <= to1) then tax_bracket = (&salary-from1)*rate;

run;- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

It's not a good idea to mix macro and data step code in this way because they have different compilation and execution phases issues like this are almost inevitable. There are a number of different ways of doing this without a macro at all but if you have to use one this should work

data tax;

input from1 1-6 to1 7-20 rate 21-24;

datalines;

0 18567 0.1

18568 34821 0.15

34822 65733 0.2

65734 9999999 0.25

;

run;

%macro taxes (salary);

data tax_brackets;

set tax;

if (&salary > to1) then do;

tax_bracket = (to1 - from1)*rate;

end;

else if (from1 <= &salary <= to1) then do ;

tax_bracket = (&salary-from1)*rate;

end;

%mend;

%taxes (45000);- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

You need to remember that macro code is used to GENERATE SAS code. It does not know what 'from1' or 'to1' are or even what a data step or proc step are. It is just generating code that SAS will then compile and run the same as if you had typed the code yourself.

If you turn on the MPRINT and MLOGIC options it is pretty easy to see what code the macro is generating and why.

So let's try it.

%macro taxes (salary);

data tax_brackets;

set tax;

%if (&salary > to1) %then %do;

tax_bracket = (to1 - from1)*rate;

%end;

%else %if (from1 <= &salary <= to1) %then %do ;

tax_bracket = (&salary-from1)*rate;

%end;

run;

%mend;

options mprint mlogic;

%taxes (45000);

So it generates this code:

MLOGIC(TAXES): Beginning execution.

MLOGIC(TAXES): Parameter SALARY has value 45000

MPRINT(TAXES): data tax_brackets;

MPRINT(TAXES): set tax;

MLOGIC(TAXES): %IF condition (&salary > to1) is FALSE

MLOGIC(TAXES): %IF condition (from1 <= &salary <= to1) is TRUE

MPRINT(TAXES): tax_bracket = (45000-from1)*rate;

MPRINT(TAXES): run;Note that macro comparisons will use %EVAL() which can only do integer numeric comparisons and then only when both expressions look like integers. The string 'from1' and 'to1' definitely do NOT look like intergers.

So '45000' comes before 'to1' since '4' comes before 't' so it will go down the ELSE clause.

Now why does (from1 <= &salary <= to1) evaluate to TRUE? Because the macro processor does NOT split this into two comparisons like SAS would. So instead it evaluatiing the expression ((from1 <= &salary) AND (&salary <= to1)) the macro processor will evaluate the binary operators from left to right. So consider what happens if you evaluate the expression ((from1 <= &salary) <= to1). The first part is false since 'f' comes after '4' and it will produce the string '0'. And '0' comes before 't' so the overall result is true.

If you want the data step to make different decisions for each observation then you need to use normal IF/THEN statements and not try to use macro code.

%macro taxes(salary);

data tax_brackets;

set tax;

if from1 <= &salary then do;

tax_bracket = (min(to1,&salary) - from1)*rate;

end;

run;

%mend;

If you did want to have the macro decide which of the two functions to use for every observation then you would need to give the macro the values of the upper and lower bounds that it needs to make the decision.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

I don't think that is how taxes work. You only pay the higher rate on the part of the salaray that falls in the higher bracket.

You probably want something more like this. First let's create a tax table and some example employee data.

data tax_brackets;

bracket+1;

input from1 to1 rate ;

cards;

0 18567 0.10

18568 34821 0.15

34822 65733 0.20o

65734 . 0.25

;

data have;

input id salary ;

cards;

1 10000

2 20000

3 40000

4 70000

;

Now let's combine the two tables. I will output both the detailed by bracket taxes and the overall per employee taxes.

data detail(drop=effective_rate rename=(tax=cummulative_tax))

final(drop=partial_tax from1 to1

rename=(rate=marginal_rate bracket=marginal_bracket)

)

;

set have ;

if 0 then set tax_brackets ;

do p=1 to nobs until (salary < to1);

set tax_brackets point=p nobs=nobs;

partial_tax=rate*(min(salary,to1) - from1);

tax = sum(0,tax,partial_tax);

output detail;

end;

effective_rate = divide(tax,salary);

output final;

run;Learn how use the CAT functions in SAS to join values from multiple variables into a single value.

Find more tutorials on the SAS Users YouTube channel.

SAS Training: Just a Click Away

Ready to level-up your skills? Choose your own adventure.