- Home

- /

- Programming

- /

- SAS Procedures

- /

- Re: Interpreting regression procedure

- RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Hi

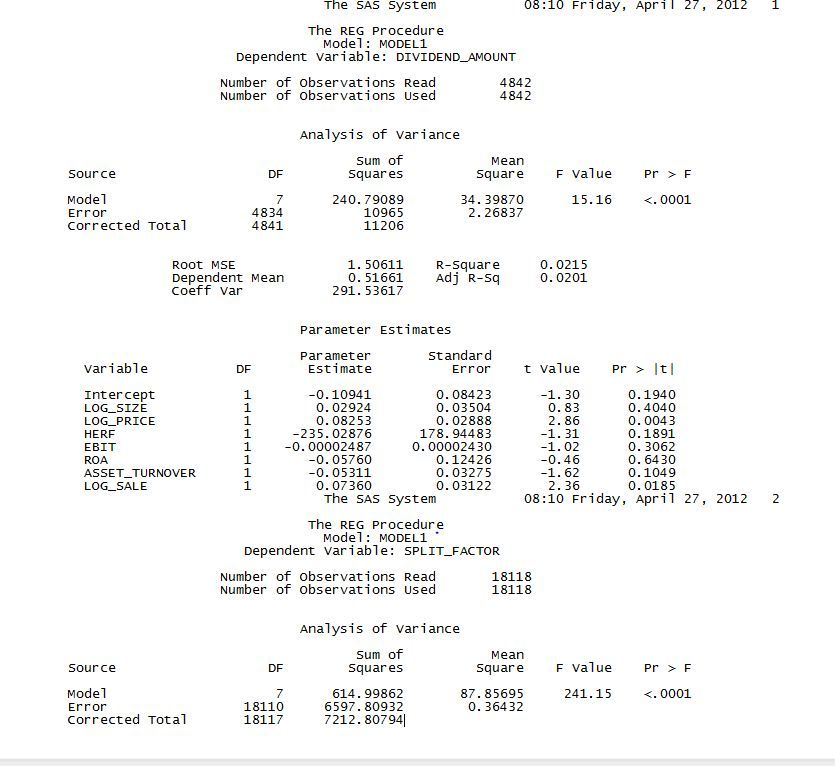

Please see attached.

I am seeking assistance in interpreting my regression results. Unfortunately I am only a beginner in econometrics so Im not sure what to look at really... What determines the stronger relationship/best explanatory variable?

What figure or score should I be looking at to assert whether the regression explains the relationship well?

Are there any problems I need to consider when interpreting these results?

Ie: Panel data, Long time period, etc.

Any help/input would be greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

I'd be very concerned about the R-Squared value being so close to zero. To me this says:

- The model doesn't really fit the data; or

- You have severe outliers; or

- both of the above

You need to plot the data, and examine residuals against independent variables, and residuals against predicted values, and see if the problems I mentioned are apparent.

Paige Miller

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Thanks PaigeMiller, what does the F value indicate?

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Maybe you should take a step back. You wouldn't drive a car without knowing what the gas pedal, brakes and steering wheel do. I think you need to do some reading on regression basics, because right now you are doing the equivalent of driving a car without knowing what the gas pedal, brakes and steering wheel do.

The F-value is a test to see if the observed relationship in the data could have arisen by random chance.

Paige Miller

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

I agree, ive bought some books but amazon are taking their sweet time. Could you reccommend any online texts for the econometric layman?

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

As I haven't had the need to look for such a thing since the Internet began, I have no recommendation. I'm sure you can find lots of tutorials using Google.

Paige Miller

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Try the following links to help get you started:

http://www.statsoft.com/textbook/

and

http://www.ats.ucla.edu/stat/sas/webbooks/reg/default.htm

and then come back with more specific questions.

Or hire a statistician ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

PaigeMiller is very careful to notice your R square is nearly zero, which means your model is very bad.

Did you try to use stepwise or backwise to select a optimum sub-variables.

Regression is only suited that observations is independent for each other .

If your data is times serial data ,then time serial analysis skill should be a good choice.

But Ignore the zero R square . From the output, LOG_PRICE and LOG_SALE is very significant, these two variable is a important influence factor for explain variables.

Ksharp

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Ksharp wrote:

But Ignore the zero R square . From the output, LOG_PRICE and LOG_SALE is very significant, these two variable is a important influence factor for explain variables.

I don't think you can ignore a nearly zero R-squared. Even though LOG_PRICE and LOG_SALE are significant (I don't think I would say "very significant"), they are explaining a tiny amount of the variability in the data.

Paige Miller

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Paige,

Sorry to misunderstand you.

"ignore" I mean is assuming we don't consider it ,Just like R square is about 0.7-0.9 (a normal good value ) as usual.

I know what the R means , it is the correlation coefficient between the actual explain variable' value and the predicting value by using this model.

0.02 is to say your predicting value is almost non-relation with the actual value , thus, this model is very very bad.

What I am trying to tell OP is let him know how to read the P-value and explain the result.

Ksharp

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

"Did you try to use stepwise or backwise to select a optimum sub-variables."

This sounds interesting, how do I use stepwise/backwise to select the optimum sub-variables? May make my life a lot easier in explaining the regression

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Hi.

You can check the documentation as to SAS/STAT , there are lots of example to illustrate it.

About regression model ,there are lots and lots of stuff to talk (general linear model, mixed model, logistical model .......), you need buy a stat book, and understand the basic statistical theory(i.e. the meaning of P-value and how to make a H0 hypothesis ...........)

Learn the difference between classical and Bayesian statistical approaches and see a few PROC examples to perform Bayesian analysis in this video.

Find more tutorials on the SAS Users YouTube channel.

SAS Training: Just a Click Away

Ready to level-up your skills? Choose your own adventure.