[ I have moved this post to 'Forecasting and Econometrics' board ]

Hello @Sowmya_123 ,

Always a good idea to give a little bit of context when posing a question!

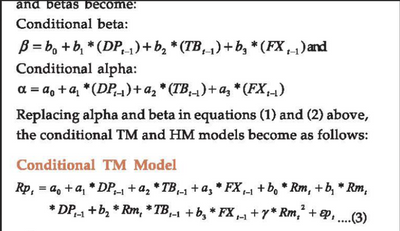

Are the shortcuts TM and HM referring to Treynor and Mazuy (1966) and Henriksson and Merton (1981)?

And are you dealing with stock markets (stock picking, stock pricing, funds, ...)?

So, you have regression coefficients changing over time.

Have you looked at what is known in econometric literature as :

- dynamic regression models

- random effects models (as opposed to fixed effects models)

?

Thanks,

Koen