- Home

- /

- Analytics

- /

- SAS Data Science

- /

- a question regarding statistics

- RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

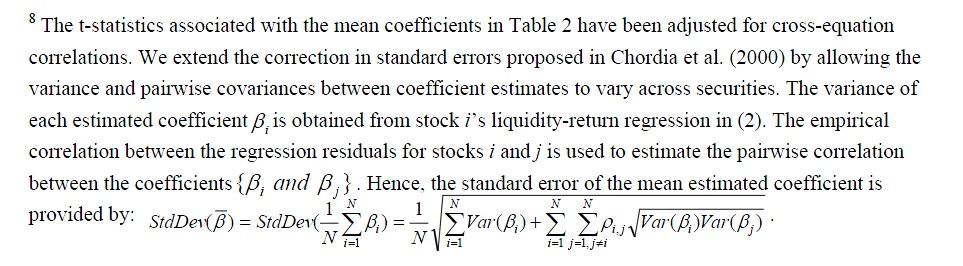

i have found this explanation so far can you please guide me if you understand what the author has done??

"The t-statistics associated with the mean coefficients in Table 2 have been adjusted for cross-equation correlations. We extend the correction in standard errors proposed in Chordia et al. (2000) by allowing the variance and pairwise covariances between coefficient estimates to vary across securities. The variance of each estimated coefficientβi is obtained from stock i’s liquidity-return regression in (2). The empirical correlation between the regression residuals for stocks i and j is used to estimate the pairwise correlation between the coefficients{βi andβj }. Hence, the standard error of the mean estimated coefficient is ...

please find the attached JPEG file it is just snapshot of the equation used, dont know how to enter an equation here. thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

The equation given is a pretty standard summation version of the standard error of a difference between two correlated variables. Plug in the necessary variables, get the std error, and calculate the t value as the difference between the estimates divided by the standard error.

Steve Denham

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

A possibility is to extend 's idea of a shift to GLM even farther to use MIXED. The following is untested, but might work:

ods output corrb=corrb solutionf=solutionf;

proc mixed;

class stockName;

model liq = stockName x z d / solution noint corrb;

run;

The corrb option should give the pairwise correlations you need (there may need to be some nesting to get stuff right, but for now try this). The regression coefficients should be in the solutionf dataset.

Steve Denham

Message was edited by: Steve Denham

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Maybe all you need is some descriptive statistics for a population of 500 regression parameters. Maybe, you could do something simple as in the folowing example:

proc sort data=sashelp.cars out=cars; by origin; run;

proc reg data=cars outest=carsEst noprint;

by origin;

model horsepower = engineSize Weight;

run;

proc summary data=carsEst noprint;

var engineSize Weight;

output out=carsMeanEst mean= std= probt= / autoname autolabel;

run;

proc print data=carsMeanEst; run;

PG

PS. Just don't associate my name to that idea! - PG

- « Previous

-

- 1

- 2

- Next »

Use this tutorial as a handy guide to weigh the pros and cons of these commonly used machine learning algorithms.

Find more tutorials on the SAS Users YouTube channel.