- Home

- /

- Programming

- /

- SAS Procedures

- /

- PROC EXPAND

- RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

How can I obtain the moving slope coefficients of regression analysis in a data series, like in PROC EXPAND convert /transformout=( MOVTVALUE n) or (MOVSTD n) ? There are thousands of sales data and we want to know the sales trend.

ENTITY DATE sales

aaa 2003/1/2 7864500

aaa 2003/1/3 5963400

aaa 2003/1/6 7923300

aaa 2003/1/7 11907000

aaa 2003/1/8 9509700

aaa 2003/1/9 10711600

aaa 2003/1/10 9961400

aaa 2003/1/13 10499100

aaa 2003/1/14 7569200

aaa 2003/1/15 8147600

aaa 2003/1/16 10112800

aaa 2003/1/17 17332600

aaa 2003/1/21 8927000

aaa 2003/1/22 9433100

aaa 2003/1/23 8371500

aaa 2003/1/24 7748000

aaa 2003/1/27 9307800

aaa 2003/1/28 8018400

aaa 2003/1/29 7757500

aaa 2003/1/30 7349500

aaa 2003/1/31 9744100

aaa 2003/2/3 6483500

aaa 2003/2/4 9216200

aaa 2003/2/5 7427500

aaa 2003/2/6 7755200

...

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

PROC EXPAND can be a useful tool for rolling slopes, but you have to create cross-products (to be summed) prior to proc expand, and calculate beta afterwards. Here's an example generating rolling 12-month slopes of closing prices in sashelp.stocks:

proc sort data=sashelp.stocks out=stocks;

by stock date;

run;

data vneed /view=vneed;

set stocks (keep=stock date close);

X=intck('month','01jan1984'd,date);

XY=X*close;

run;

proc expand data=vneed out=need2 (where=(n=12)) method=none;

by stock;

id date;

convert close=n / transformin=(*0) transformout=(+1 movsum 12);

convert X=sumXX / transformout=(movuss 12);

convert XY=sumXY / transformout=(movsum 12);

convert close=meanY / transformout=(movave 12);

convert X=meanX / transformout=(movave 12);

run;

data want;

set need2;

beta = (sumXY - n*meanX*meanY) / (sumXX - n*meanX*meanX);

run;

It's relatively simple because you just want the slope. If you define y=Y-mean(Y) and x=X-mean(X), (i.e. "de-meaned" X and Y), then the beta coefficient (slope) of Y regressed on X is the ratio of the sum(x*y)/sum(x*x).

So no matrices needed, and the numerator and denominator above are functions of the (1) sum of products of X*Y, (2) sum of squared X, and (3) the means of X and Y.

The hash OUTPUT method will overwrite a SAS data set, but not append. That can be costly. Consider voting for Add a HASH object method which would append a hash object to an existing SAS data set

Would enabling PROC SORT to simultaneously output multiple datasets be useful? Then vote for

Allow PROC SORT to output multiple datasets

--------------------------

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Is this a continuously moving slope calculation? Or a specific window?

The functions available by PROC EXPAND are here: http://support.sas.com/documentation/cdl/en/etsug/63939/HTML/default/viewer.htm#etsug_expand_sect026...

I don't think there's directly a regression slope coefficient, so my default would be to use data step functions to manually calculate the slope at each line.

I'm also 99% sure that this has been asked and answered on here in the last 6 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

It is a continuously moving slope calculation.

Since there are thousands of sales data, it may not be practical to manually calculate the slope at each line if, for example, we want to know each month (30 days) sales trend (slope coefficient) difference.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

The number of lines wouldn’t matter to the calculation...

It’s not like you’d type out a formula for each line, just retain the components.

How are you handling time? I’m assuming that’s the x, or do you have another variable?

@vickyCh wrote:

It is a continuously moving slope calculation.

Since there are thousands of sales data, it may not be practical to manually calculate the slope at each line if, for example, we want to know each month (30 days) sales trend (slope coefficient) difference.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

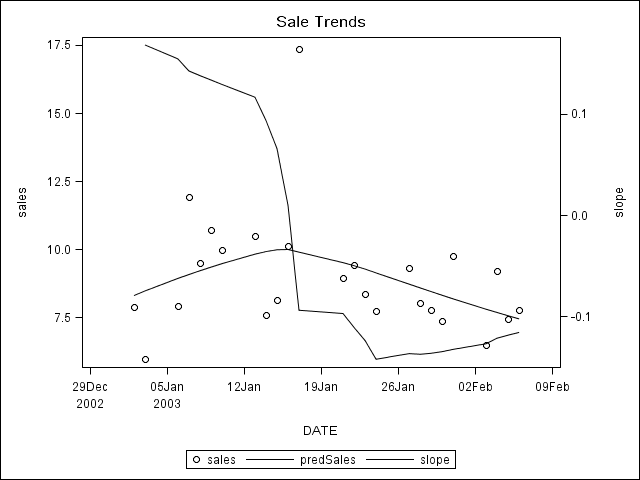

Maybe you could start with:

data have;

input ENTITY $ DATE :yymmdd10. sales :12.6;

format date yymmdd10. sales best7.2;

datalines;

aaa 2003/1/2 7864500

aaa 2003/1/3 5963400

aaa 2003/1/6 7923300

aaa 2003/1/7 11907000

aaa 2003/1/8 9509700

aaa 2003/1/9 10711600

aaa 2003/1/10 9961400

aaa 2003/1/13 10499100

aaa 2003/1/14 7569200

aaa 2003/1/15 8147600

aaa 2003/1/16 10112800

aaa 2003/1/17 17332600

aaa 2003/1/21 8927000

aaa 2003/1/22 9433100

aaa 2003/1/23 8371500

aaa 2003/1/24 7748000

aaa 2003/1/27 9307800

aaa 2003/1/28 8018400

aaa 2003/1/29 7757500

aaa 2003/1/30 7349500

aaa 2003/1/31 9744100

aaa 2003/2/3 6483500

aaa 2003/2/4 9216200

aaa 2003/2/5 7427500

aaa 2003/2/6 7755200

;

proc loess data=have plots(only)=fit;

model sales=date / direct smooth=0.8;

output out=want predicted=predSales;

run;

data wantSlope;

set want;

slope = dif(predSales) / dif(date);

run;

title "Sale Trends";

proc sgplot data=wantSlope;

scatter x=date y=sales;

series x=date y=predSales;

series x=date y=slope / y2axis;

run;

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

PROC EXPAND can be a useful tool for rolling slopes, but you have to create cross-products (to be summed) prior to proc expand, and calculate beta afterwards. Here's an example generating rolling 12-month slopes of closing prices in sashelp.stocks:

proc sort data=sashelp.stocks out=stocks;

by stock date;

run;

data vneed /view=vneed;

set stocks (keep=stock date close);

X=intck('month','01jan1984'd,date);

XY=X*close;

run;

proc expand data=vneed out=need2 (where=(n=12)) method=none;

by stock;

id date;

convert close=n / transformin=(*0) transformout=(+1 movsum 12);

convert X=sumXX / transformout=(movuss 12);

convert XY=sumXY / transformout=(movsum 12);

convert close=meanY / transformout=(movave 12);

convert X=meanX / transformout=(movave 12);

run;

data want;

set need2;

beta = (sumXY - n*meanX*meanY) / (sumXX - n*meanX*meanX);

run;

It's relatively simple because you just want the slope. If you define y=Y-mean(Y) and x=X-mean(X), (i.e. "de-meaned" X and Y), then the beta coefficient (slope) of Y regressed on X is the ratio of the sum(x*y)/sum(x*x).

So no matrices needed, and the numerator and denominator above are functions of the (1) sum of products of X*Y, (2) sum of squared X, and (3) the means of X and Y.

The hash OUTPUT method will overwrite a SAS data set, but not append. That can be costly. Consider voting for Add a HASH object method which would append a hash object to an existing SAS data set

Would enabling PROC SORT to simultaneously output multiple datasets be useful? Then vote for

Allow PROC SORT to output multiple datasets

--------------------------

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

I would like to say a big thank you to all of you for your help, especially mkeintz.

That is exactly what we want.

April 27 – 30 | Gaylord Texan | Grapevine, Texas

Registration is open

Walk in ready to learn. Walk out ready to deliver. This is the data and AI conference you can't afford to miss.

Register now and save with the early bird rate—just $795!

Learn the difference between classical and Bayesian statistical approaches and see a few PROC examples to perform Bayesian analysis in this video.

Find more tutorials on the SAS Users YouTube channel.

SAS Training: Just a Click Away

Ready to level-up your skills? Choose your own adventure.