- Home

- /

- SAS Communities Library

- /

- SAR90 Case Process Flow

- RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

SAR90 Case Process Flow

- Article History

- RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

The purpose of this blog is to provide a summary of the SAR90 case that’s automatically created as part of the SAS Anti-Money Laundering case investigation process.

In SAS Anti-Money Laundering, a case is a collection of alerts, entities, and supporting documentation into one object so that you can determine whether suspicious behavior exists. A case has a predefined workflow, which is initiated when the case is created. Workflows consist of tasks assigned to users or groups, and they automatically move to the next task after the current task is complete.

In the case workflow, the AML investigator is responsible for completing the case investigation and for indicating whether a SAR, or a suspicious activity report, is needed. The AML investigator is also responsible for creating this regulatory report. If a case has a report associated with it, then the case first gets passed to the AML manager for review before it can be closed. After the case is closed, a random selection of cases is passed to quality assurance for review.

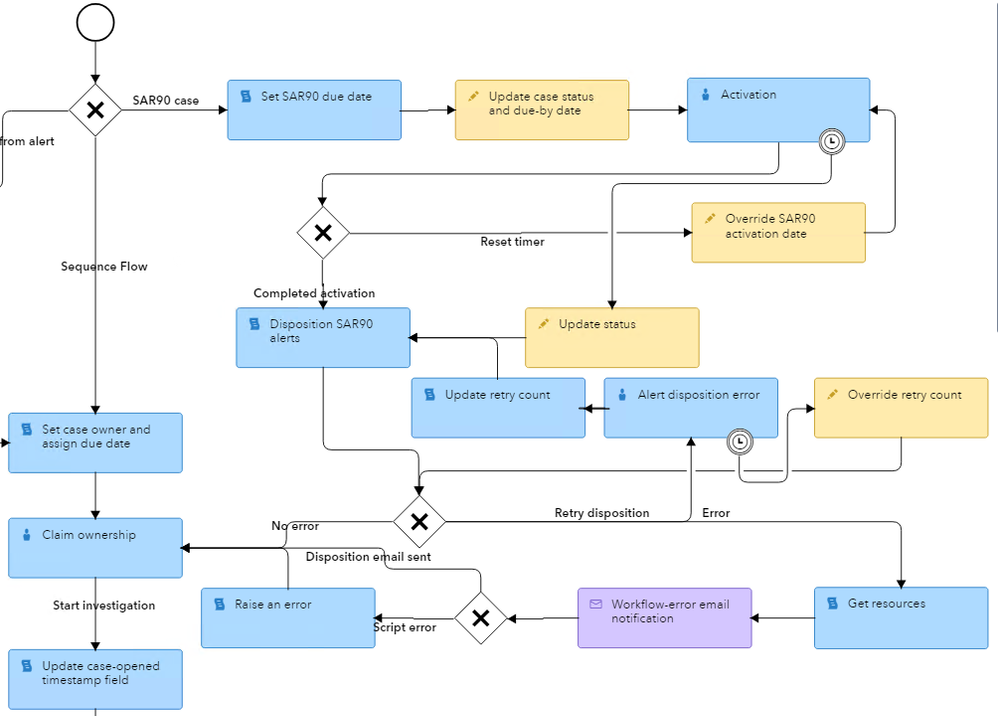

In addition, SAS Anti-Money Laundering automatically creates a SAR90 follow-up case that enables you to review and report continuing suspicious activity. Institutions typically start a continuing activity review case 90 days after a SAR case has been filed and, if appropriate, file a continuing activity SAR within 120 days of the original SAR filing date. This practice enables law enforcement to become aware of the continuing nature of previously reported activity, and it also enables the institution to determine whether an internal policy action might be appropriate.

After a SAR is filed and is accepted, the system creates a SAR90 case that has a status of Suspended by default. This SAR90 case includes all subjects from the parent, or original case, and the owner of this new case is set to the same as the owner of the parent case as well. All the SAR90 case subject’s alerts are dispositioned to the SAR90 queue. This new SAR90 case is automatically activated after 90 days. If you plan on working on the SAR90 case prior to the 90 days, you can activate the SAR90 case. In addition, if a SAR90 case is about to expire, you can reset the timer to extend it another 90 days.

SAS Anti-Money Laundering makes it very simple to continually review your customers, including the ones that already have a SAR filed. To view more information about our SAS Anti-Money Laundering solution, please visit

https://support.sas.com/en/software/sas-anti-money-laundering-support.html.

April 27 – 30 | Gaylord Texan | Grapevine, Texas

Registration is open

Walk in ready to learn. Walk out ready to deliver. This is the data and AI conference you can't afford to miss.

Register now and save with the early bird rate—just $795!

SAS AI and Machine Learning Courses

The rapid growth of AI technologies is driving an AI skills gap and demand for AI talent. Ready to grow your AI literacy? SAS offers free ways to get started for beginners, business leaders, and analytics professionals of all skill levels. Your future self will thank you.

- Find more articles tagged with:

- GEL