- Home

- /

- Analytics

- /

- Stat Procs

- /

- Re: please, help me with GMM estimation on asset pricing model

- RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Hello

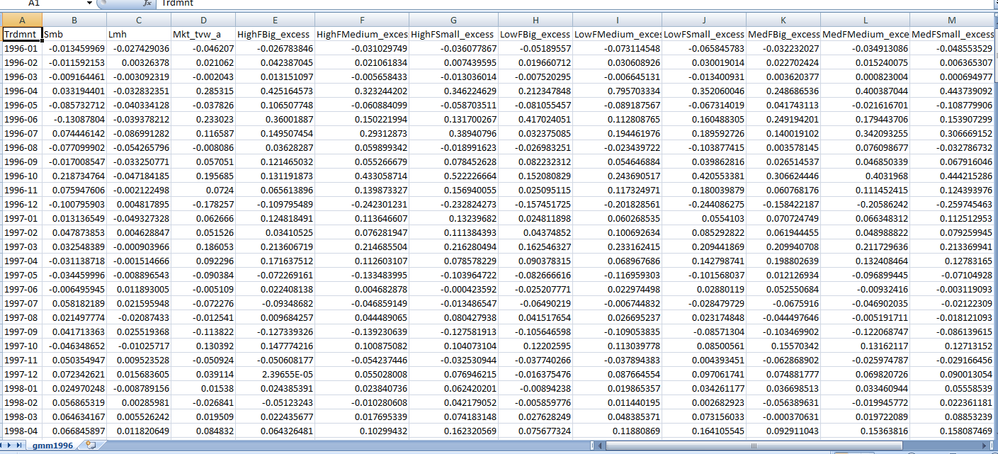

I am new to sas. I used sas to form my own FF portfolios for the Chinese stock markets.

So i am ok with sas when it's about data management but can't do GMM estimation properly.

i had a hard time figuring a way

Basically, I want to estimate an asset pricing model using GMM:

But i don't know how to properly specify the moment conditions using Proc model.

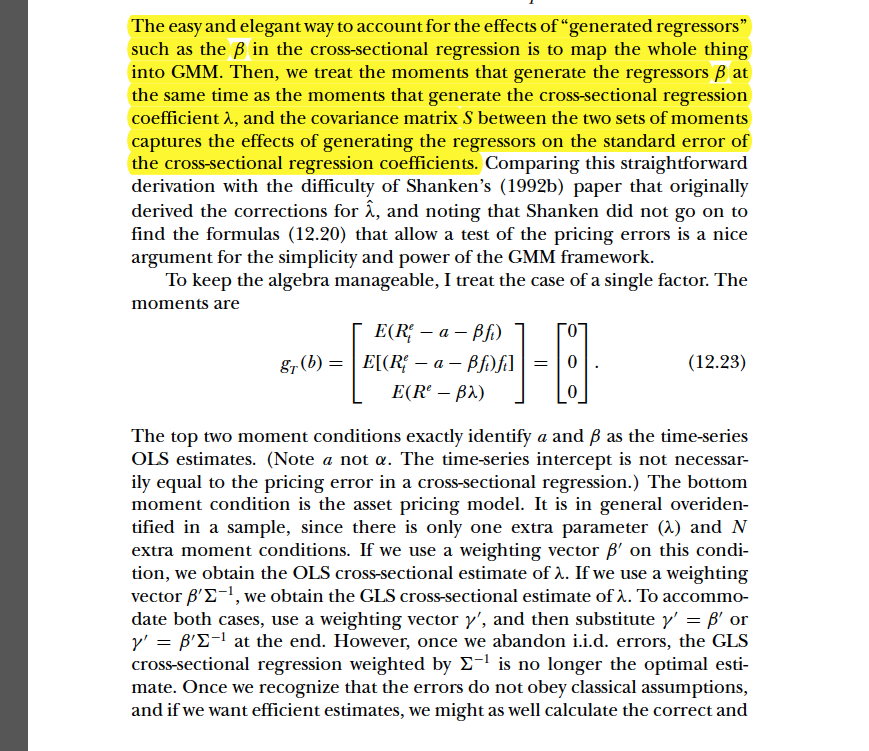

It is about implementing a linear factor asset pricing model.

I have nine Fama-French portfolios and three risk factors.

I need to run a time-series regressions to get the coefficient estimates on three risk factors for each of the nine portfolio. This is the first moment condition.

Then i need to run a cross-section regression. that is to regress coefficient estimates from the above regression which becomes the right hand variables on the

average excess return of the portfolios. this is the second moment conditions.

The reason for using GMM is that the covariance matrix is supposed to take care the generated regressor problem and gives me robust inference.

But i really don't know how to do it using Proc model. I did it in a lot way imaginable, but the results i get are nonsensical, so they are obviously wrong.

I attaches the the screenshot from cochrane's book where he specifies the moment conditions and what the spreadsheet look like.

any help and suggestion is greatly appreciated.

Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

I have a couple of suggestions.

1) Post the data and the example SAS file you are working on. (so we know where this is falling down)

2) Repost this in Forecasting and Econometrics as the "right" eyeballs are likely to see it over there.

Best-Ken

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

thank you very much for your advice. I will do that.

Don't miss out on SAS Innovate - Register now for the FREE Livestream!

Can't make it to Vegas? No problem! Watch our general sessions LIVE or on-demand starting April 17th. Hear from SAS execs, best-selling author Adam Grant, Hot Ones host Sean Evans, top tech journalist Kara Swisher, AI expert Cassie Kozyrkov, and the mind-blowing dance crew iLuminate! Plus, get access to over 20 breakout sessions.

ANOVA, or Analysis Of Variance, is used to compare the averages or means of two or more populations to better understand how they differ. Watch this tutorial for more.

Find more tutorials on the SAS Users YouTube channel.