- RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

proc iml;

/* the number of assets */

n=2;

/* riskless rate - Government's bond rate */

f=0.02 ;

/* Start Calculated */

/* two assets and populate data */

asset=j(100,n,.);

call randseed(1234);

call randgen(asset,'normal');

/* the expect return of two assets (mean) */

return=asset[:,];

/* the variance and covariance of two assets */

cov=cov(asset);

/* the variance of portfolio */

new_cov=2#cov-diag(vecdiag(cov));

col=col(new_cov);

row=row(new_cov);

idx=loc(col>=row);

p_cov=row[idx]||col[idx]||new_cov[idx];

/* p[1] is expect return of porfolio

p[2] is variance of porfolio */

p=j(1,2,.);

/* the tangency portfolio */

start max_slope(x) global(f,p,p_cov,return);

p[1]=(return#x)[+];

p[2]=(x[p_cov[,1]]#x[p_cov[,2]]#p_cov[,3])[+];

/*riskless rate's variance is zero*/

k=(p[1]-f)/p[2];

return (k);

finish;

ods output IterHist=IterHist;

con=repeat({0,1,1},1,n)||{. .,. .,0 1};

x=j(1,n,1/n);

optn={1 3};

call nlptr(xres,rc,"max_slope",x,optn,con);

quit;

/************************************/

/************************************/

/************************************/

/************************************/

/* Test if it is tangency portfolio */

/* Take two assets above for example*/

data _null_;

set IterHist;

call symputx('k',OptCrit);

call symputx('f','0.02');

run;

proc iml;

/* The same code as above. Start */

n=2;

f=0.02 ;

asset=j(100,n,.);

call randseed(1234);

call randgen(asset,'normal');

return=asset[:,];

cov=cov(asset);

new_cov=2#cov-diag(vecdiag(cov));

col=col(new_cov);

row=row(new_cov);

idx=loc(col>=row);

p_cov=row[idx]||col[idx]||new_cov[idx];

/* The same code as above. End*/

p=j(100,2);

x=j(1,n,.);

do i=1 to 100;

x[1]=0.01#i;

x[2]=1-x[1];

p[i,1]=(return#x)[+];

p[i,2]=(x[p_cov[,1]]#x[p_cov[,2]]#p_cov[,3])[+];

end;

create test from p[c={return variance}];

append from p;

close;

quit;

ods graphics/reset;

proc sgplot data=test;

series x=variance y=return/ lineattrs=(thickness=2) legendlabel='Portfolio' curvelabel='Efficient Frontier';

lineparm x=0 y=&f slope=&k/ legendlabel='Tangency Portfolio' lineattrs=graphdata2(thickness=2);

refline &f / axis=y;

xaxis label='Portfolio Variance';

yaxis label='Portfolio Return';

run;

/* Bingo !!!! */

/************************************/

/************************************/

/************************************/

/************************************/

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Thanks for this program. If I used correlated assets, I don't seem to get the correct tangency curve. What needs to change if you use the following?

Sigma = {1 0.2, 0.2 1};

mu = {0 0};

asset = randnormal(100, mu, Sigma); /* generate obs from MVN(mu, Sigma) */

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

@Rick,

You are right. I just simulate lots of portfolios ,and can't guarantee you get efficient portfolio frontier.

If you want get that efficient portfolio frontier, you need solve lots of optimize problem.

Something like :

return=asset[:,];

start min_variance(x) global(cov);

/*a portfolio 's variance*/

k=x*cov*x`;

return (k);

finish;

do r=0.01 to 0.1;

/*constraint portfolio's return is 0.01,0.02,0.03,0.04...........*/

/* return*x`=0.01,0.02,0.03,0.04 */

/*change the following CON, I forgot syntax*/

con=repeat({0,1,1},1,n)||{. .,. .,0 return};

x=j(1,n,1/n);

optn={1 3};

call nlptr(xres,rc,"min_variance",x,optn,con);

print xres ;

end;

- Mark as New

- Bookmark

- Subscribe

- Mute

- RSS Feed

- Permalink

- Report Inappropriate Content

Finally I have some time to go through.

Better make mu great than 0 .

The code above is too old.

You can get my new code at SAS Global Forum 2017 ,

Search "Get Tangency Portfolio" at SGF2017.

proc iml;

Sigma = {1 0.2, 0.2 1};

mu = {0.2 0.2};

asset = randnormal(10000, mu, Sigma); /* generate obs from MVN(mu, Sigma) */

/* the expect return of two assets (mean) */

return=asset[:,];

/* the variance and covariance of two assets */

cov=cov(asset);

start min_variance(x) global(cov);

return (x*cov*x`);

finish;

x=j(1,2,0.5);

optn={0 1 0.001};

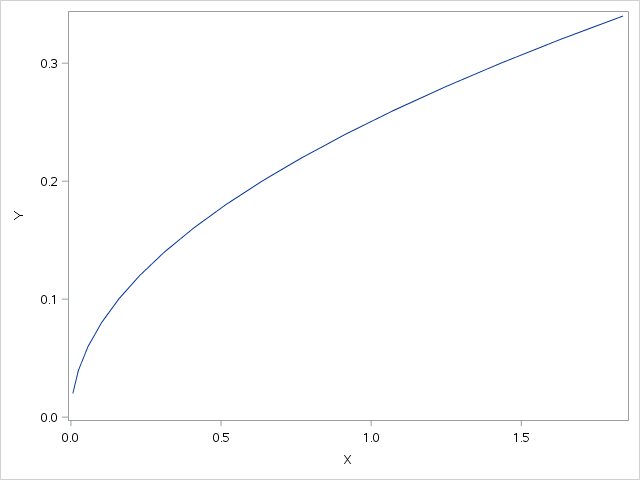

do r=0.02 to 0.34 by 0.02;

con={ 0 0 . .,

1 1 . .}//

(return||0||r);

call nlpnrr(rc,xres,"min_variance",x,optn,con);

r_cov=r_cov//(r||xres*cov*xres`);

end;

print r_cov;

call series x=r_cov[,2] y=r_cov[,1];

quit;Don't miss out on SAS Innovate - Register now for the FREE Livestream!

Can't make it to Vegas? No problem! Watch our general sessions LIVE or on-demand starting April 17th. Hear from SAS execs, best-selling author Adam Grant, Hot Ones host Sean Evans, top tech journalist Kara Swisher, AI expert Cassie Kozyrkov, and the mind-blowing dance crew iLuminate! Plus, get access to over 20 breakout sessions.

Learn how to run multiple linear regression models with and without interactions, presented by SAS user Alex Chaplin.

Find more tutorials on the SAS Users YouTube channel.